Financial statements are filled with opinions. GAAP aside, profit is an outcome of managerial decisions, timing, and policies. The value of your assets can be impacted by decisions related to what gets capitalized and methods of depreciation or amortization. Performance can be smoothed through revenue recognition manipulation. Accruals might make sense to accountants, but they don’t reflect transactional reality. The only two numbers that are facts – verifiable and indisputable – on your financial statements are cash and debt balances.

Cash is cash and much has been written about it its importance in your business. You’ve heard it – cash is king; a company cannot function without it, as humans cannot function without oxygen; poor management can cause a downward spiral, while running out of cash is the official cause of death. So, how do you move this critical component of your business to top of mind awareness for your management team? How do you create a culture of cash management and transparency? Here are three tips to assure the cash conversation has a seat at the table:

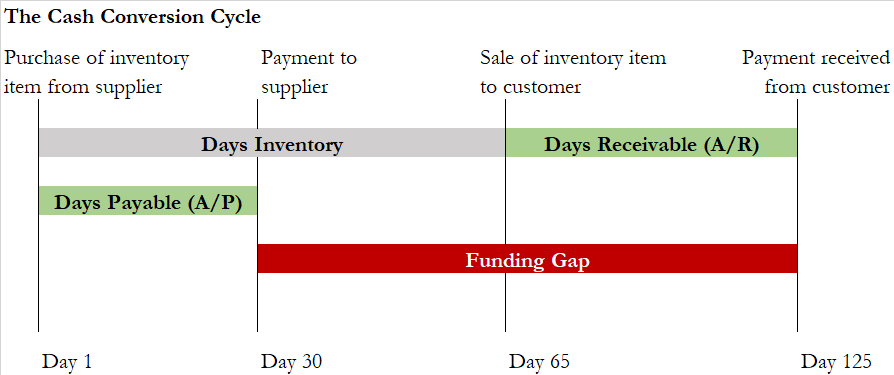

- Make sure your team knows about the Cash Conversion Cycle. The CCC measures the length of time it takes for a dollar spent on an expense or purchase to make its way back into the company in the form of a customer payment. Although leaders in departments outside of Finance and Accounting don’t need to know the formulas and calculations (DIO, DPO, DSO) for this metric, make sure they understand the fundamental idea behind this simple visual:

This flow means cash goes out the door on Day 30 to pay suppliers for inventory purchased and, depending on length of the sales cycle (days the finished goods are waiting to be sold) and the time it takes for customers to pay (days from invoicing to collection), there could be a significant funding gap (in the above example, that gap is over 3 months). Your team can influence this cycle: maybe Purchasing can negotiate more attractive terms with suppliers, Marketing should assist on differentiation and providing qualified leads to shorten the sales cycle, the Sales team can make sure they are selling to creditworthy customers, Finance and Accounting can work collections by providing early payment discounts or reducing errors on invoices that delay payments, etc.

2. Educate the team on the seven key financial levers. Teams can improve cash by working any of the following:

- Price – increase the price of your products

- Volume – sell more units at same price

- Cost of Goods Sold – reduce cost of direct inputs (materials and labor)

- Operating expense – reduce operating costs

- Accounts Receivable – faster collection from customers

- Inventory – reduce on-hand amounts

- Accounts Payable – slow down payments to suppliers/vendors

There are strategies that can be implemented on any one (or all, although it’s not recommended to tweak all at the same time) of these levers and your team can share responsibility within their functional areas. For example, Sales and Accounting can jointly monitor A/R and participate in collections, Marketing can assist with appropriate price point discussions, Purchasing/Procurement can be accountable for reducing the cost of raw materials, along with lead times.

- Track metrics and make status reports part of management meetings. Examples of discussion topics include Profitability (Gross Margin, Operating Expense, EBIT) and Working Capital (Accounts Receivable Days, Inventory Days, Accounts Payable Days). Ideally, targets should be set so the team has comparisons to measure performance.

A focus on cash management within your culture increases the runway in a rapidly growing company and – added bonus – provides a learning opportunity for your management team as they also grow their general business acumen to complement their specific functional expertise.