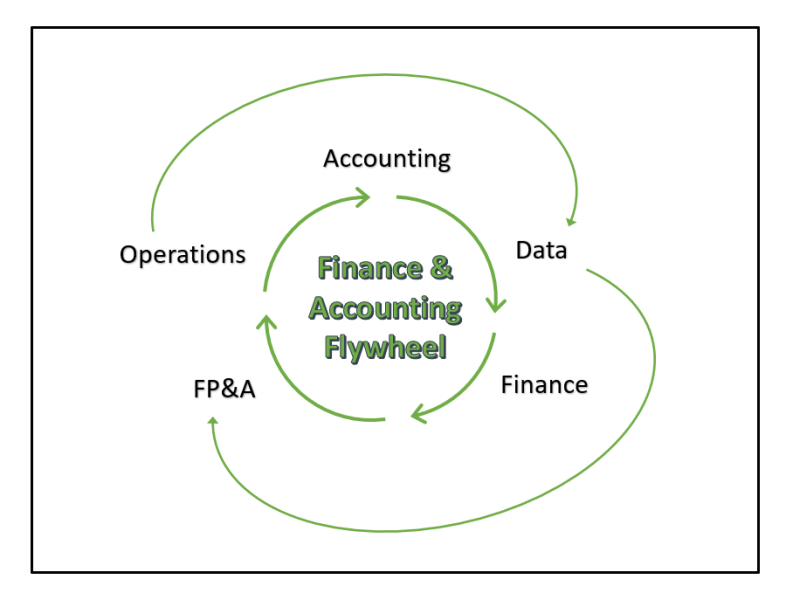

I’m fascinated with the Flywheel Effect. The idea of small, consistent, disciplined actions leading to gains in momentum and, eventually, a breakthrough where everything gets a bit easier (less force needed to turn the wheel). It’s quiet, like compounding in the investment world, and self-reinforcing.

The action of storing and releasing energy can be found in a literal, physical flywheel in a car engine, or a spin bike, or (as my daughters tell me) the butterfly stroke while swimming (hard pass). Or the flywheel can be used as a metaphor in learning a language or instrument, building a brand, or growing/improving a business.

There is an excellent, detailed description in Jim Collins book Good to Great that explains the concept at the firm level. The idea of this specific writing is to look at a flywheel on a more granular, functional level – specifically, creating a flywheel in the Finance and Accounting function. As an aside, despite how much has changed in the operating environment since Good to Great’s first edition (written in 2001!) this is still one of the business books I grab off my shelf regularly as a refresher on the things that haven’t changed in the business world. A small, consistent, disciplined action, I suppose.

The Cross-Functional Flywheel

The components of the flywheel in the larger Finance and Accounting domain don’t just focus on Finance and Accounting. The beauty of the flywheel is to find the interlocking pieces – the actions along the wheel, perhaps in adjacent functions, that build upon each other. The buildup of energy that allows for a breakthrough. For this flywheel design, I’m focusing, in order, on Accounting => Data => Finance => Financial Planning & Analysis (FP&A) => Business Operations.

It’s important to view the components as stand-alone and interlocking at the same time. Each has upstream and downstream impacts – first deconstruct and then think flow. Be careful of siloes.

Accounting

What finance and accounting people get when they use Dall-E

The foundation and starting point. In the context of the flywheel, the accounting component is purely transactional (which is not to minimize the efforts in any way – we are focusing on debits and credits here. Accountants, go with me on this). As the starting point of the build to breakthrough effort, this interlocking piece is about a clean, correct close. A clean close involves an understanding of the business to record transactions in a meaningful way – focused on compliance and accuracy, appropriate tax treatment, and the true flow of income and expense. The close will get you to net profitability, of course, but what we want here are solid transactions recorded to provide the basis for all downstream users of the information.

The small, energy storing actions for this component include a focus on timeliness, replicable processes (automation), and user-friendly, useful detail. The need for accuracy cannot be overstated. Post-close adjustments after errors have been discovered can whipsaw and derail (deflate?) the entire wheel.

Data

Source: Dall-E aka you get what you pay for

The timely, clean, correct Accounting close just provided data to the rest of the chain. This data will be used and shared along the wheel and needs to be considered as more than just records, fields, and values in a spreadsheet. It’s important to use a database mindset, even if your company doesn’t have the resources to work with a formal database. Although functions like sales, marketing, and HR have their own sources of data and points to consider, the accounting close data should be of interest and, potentially, use to all. Accounting treatments like accruals and other GAAP requirements aside, this data contains the ‘tables’ that memorialize how the company is doing as a whole – the outcome from the efforts.

Small, energy storing actions here include creating templates – the tables – that allow some manner of query. This helps automate the access and improve usability for all users and validates a single source. When cleaning or parsing data, always think about secondary users of the information.

Finance

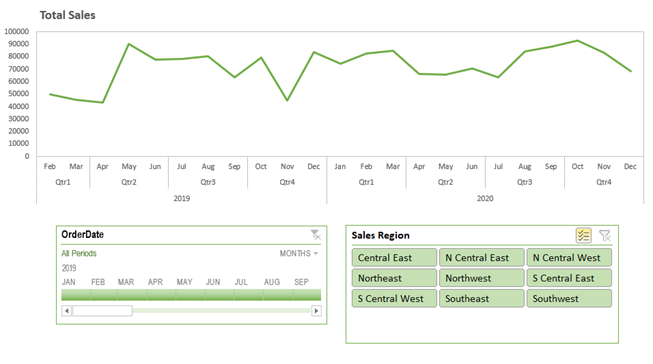

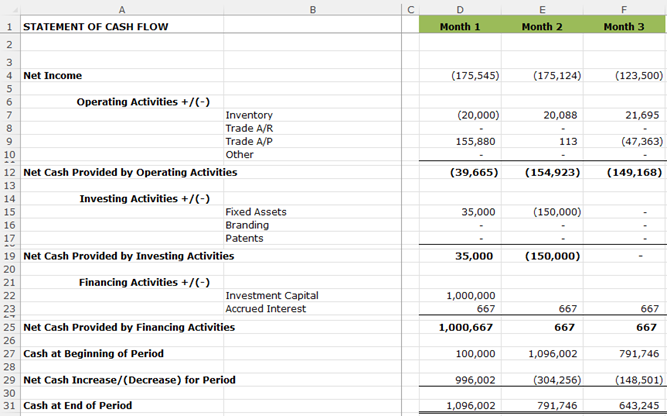

The finance component of the flywheel view is focused on reporting, risk management, working capital allocations, cash, and KPIs or other performance metrics. Importantly, the clean data provided from a solid accounting and closing process is used to communicate with users of statements, to evaluate resource allocation, and to think – always – about cash flow. This is the place where you can set up your ratios to truly understand performance, get context (particularly if there is a lender involved who requires covenant reporting), and lay out the distribution of assets and liabilities.

Depending on the business model, you could turn your focus to liquidity or profitability measures. If there are lenders and shareholders, financing and leverage may need careful consideration. In an asset intensive business, productivity and utilization may lead the day. And, ultimately, all roads lead back to value creation and the measures of EBITDA, Return on Equity (ROE), or Free Cash Flow.

In this section, it’s easier – and tempting – to focus on the Profit and Loss Statement. P&L components seem more cut and dried – we can understand the dollar value of sales and the cost of those sales. A reminder, though, do not lose sight of the Balance Sheet and, critically, the Statement of Cash Flows. These two statements can be intimidating to non-finance functions, but they don’t have to be. Approach this interlocking area with the mindset of a teacher. A patient teacher.

Small, energy storing actions in finance include timeliness of reporting to the users of the statements that honor the actual accounting results. Setting policies around working capital and cash helps manage to predictability as we see the financial results move toward the business operations section. Oh, and dashboards. Dashboards to demystify and create focus on the levers and numbers that matter.

Financial Planning & Analysis (FP&A)

We now have complete financial statements that also include ratios of interest and critical numbers. In addition to thinking about a future perspective (say, multi-year cash flow forecasting), we also need to plan for the near term. This is the area where we set company, department, or project budgets.

We can also create a financial plan for the target objectives set in business operations/strategy. This is different from a cash flow forecast in that a financial plan considers resource allocation and what it means to put numbers and effort toward what we say we are going to do as a company. We can also deconstruct the ratios and/or metrics from the finance area upstream and, importantly, run scenarios and quantify the changes to levers. With the scenarios, we can then tweak strategy, as needed. This area also allows the slicing and dicing of data to provide actionable information that can be used cross-functionally.

Small, energy storing actions for this component include preserving the ease and use of the analysis – and the coherence. Often, the results of the analysis work no longer resemble the reality of the accounting transactions and you are left with a lot of head scratching on the predictions or the forecast.

FP&A processes and knowledge help build a narrative around where the company is headed. We can then feed that story – good or bad – into the next section, Business Operations.

Business Operations

A little ppt DIY – don’t judge. Adapted from Clare Hughes Johnson, Stripe Publishing

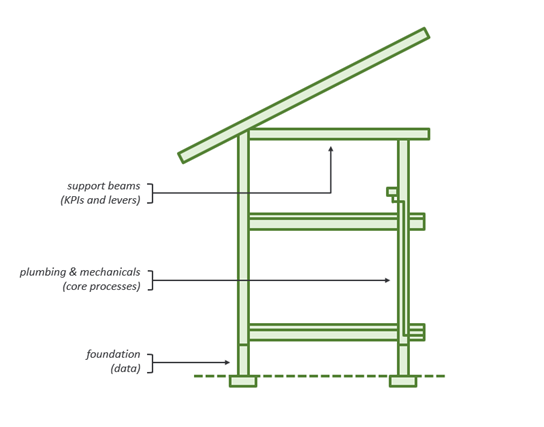

Here’s where it all comes together – execution based on a proper stream of data. Through enacting some core processes, each team can have its own mission, goals and objectives, and critical numbers to track, aligned with the mission, goals and objectives, and critical numbers for the larger organization. Effective operating systems take all of the upstream interlocking pieces and put the outputs to, ideally, good use. The consistency and coherence from the prior sections, gets repeated here over and over again for predictable results. This is the point where the data meets the know-how and heads toward breakthrough – repeatable decisions and actions that lead to accelerated performance.

Small, energy storing actions related to business operations include developing a foundation through core processes and solid infrastructure, establishing measurement and accountability mechanisms, reporting on progress and, critically, realigning when the data and results tell you it’s necessary. Optimism allowed, of course; no magical thinking.

And then, in true flywheel fashion, the cumulative efforts, the small actions and wins, create momentum and the stored energy releases. The improved business operations feed strong results back into the accounting flow; the transactions align with the actions and the close gets cleaner; solid data is used for strong financial reporting and cash flow management; FP&A is able to build out templates, budgets, forecasts, and inform on a strategy that is replicable. Now, we are accelerating performance and operating at a higher level. It all gets easier along the wheel and the improved processes make the work itself easier. When the work gets easier there is space – for ideas, innovation, improvements. The Finance and Accounting function becomes less about rote (although close checklists still matter!) and more about impact, with momentum getting people behind the larger goals and objectives. They see the positive results and understand the importance of their role in the company’s success.

A Final Note

The Flywheel Effect does not require increased headcount to start the wheel in motion. In smaller organizations, there may be a very lean team guiding the process (perhaps a team of one in the leanest of environments), and that’s ok. Ideally, when the wheel starts turning, space is created for new ideas and learning if some upskilling is needed along the chain. The important thing to remember is the mindset and to keep a clear understanding of upstream, downstream, and why the work – and the quality – matters. Clean, clear, and correct data regardless of how many touchpoints there are along the way can get the wheel turning for repeatable wins. Go forth – turn that wheel!